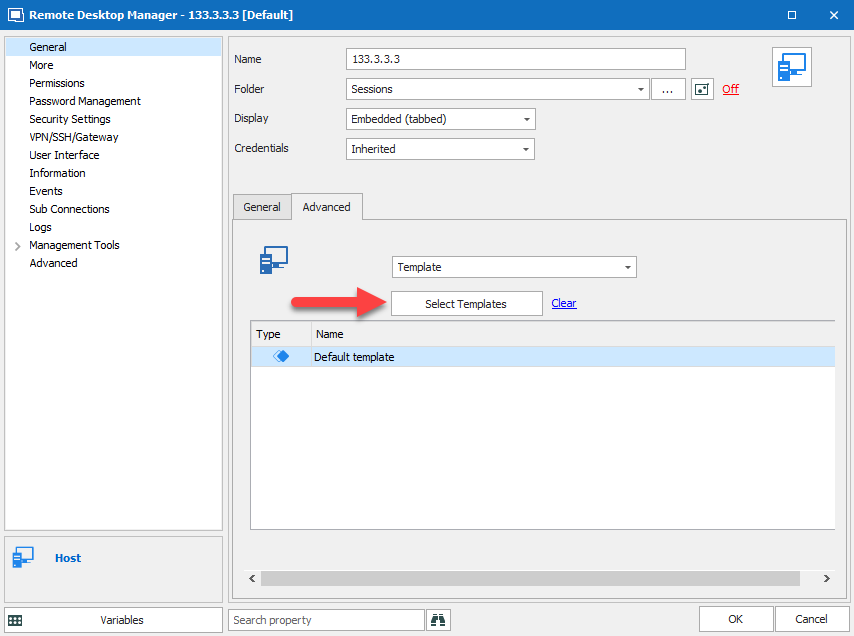

The RBI, which issued a similar alert last month, has re-issued a cautionary circular in the wake of a rising number of incidents coming to light. Related: Your credentials could be in danger- Banks warn customers of a new mobile malware If this nine-digit access code is shared with any third party, a hacker can gain remote control over the user’s device and personal information, and use that against the victim to wipe out their bank account through payment apps available on the phone. Simultaneously, the user is asked to grant certain permissions, a common practice with most apps.

On downloading this to the phone, a nine-digit code is generated.

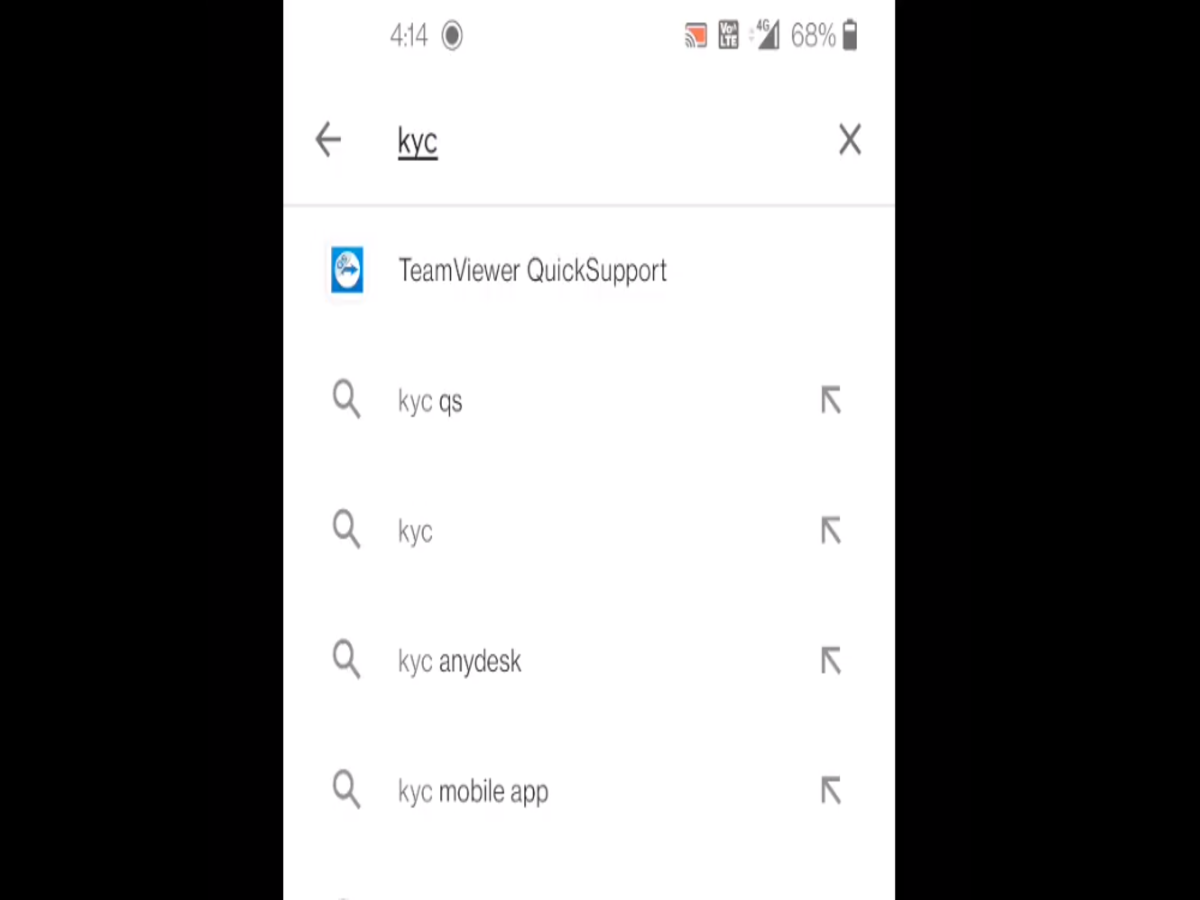

Related: How digital payment methods are changing the face of Indian economyįraudsters lure victims to download the AnyDesk app from the Play store or App store. The modus operandi of the fraud relies on access to a victim’s account through the UPI platform – specifically, via an app called ‘AnyDesk’. On 14th February, the cybersecurity and IT examination cell of the Reserve Bank of India (RBI) alerted banks of a potential tactic used by fraudsters to gain remote access to a victim’s bank account and carry out transactions.

0 kommentar(er)

0 kommentar(er)